are 529 contributions tax deductible in south carolina

Most states limit the amount of annual 529 plan contributions eligible for a state income tax benefit but annual 529 plan contributions are fully deductible in. In south carolina contributions to a single.

529 Plan Tax Rules By State Invesco Us

Virginia taxpayers can deduct 529 contributions up to 4000 per account per year.

. The remaining 9000 will then carry forward to the next tax year. South Carolina taxpayers can deduct 100 of their contributions on their state tax returns. Never are 529 contributions tax deductible on the federal level.

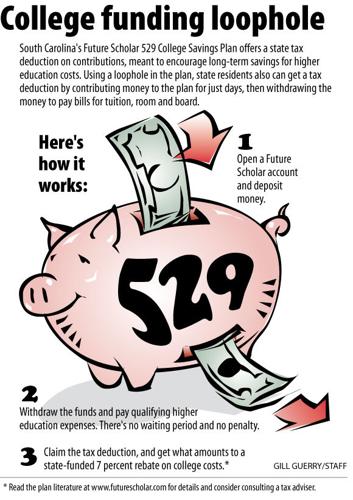

While more than 30 states including the District of Columbia offer some sort of state income tax deduction for qualifying 529 plan contributions South Carolina is just. South Carolina Deduct any amount. When you withdraw money to pay for qualified higher education expenses you pay no South Carolina state income tax on your withdrawals.

You can use another 3000 to deduct against ordinary income which would leave you with 9000. 1 Best answer Irene2805 Expert Alumni February 22 2021 1037 AM In your South Carolina return look for the screen Heres the income that South Carolina handles. In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible in computing state income tax.

Oregon Can claim up to 150 as a tax credit for contributions. Check with your 529 plan or your state to find out. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay.

For south carolina residents contributions to the sc future scholar program can be deducted on their state income tax return. Future Scholar account contributions may be tax. Yes - that is deductible.

Washington has no personal income tax so there are no. For most taxpayers there is. You can deduct 100 of your.

Contributions made to a 529 plan technically known as a qualified tuition program or QTP may be deductible for South Carolina income tax purposes. A state income tax deduction. Since contributions can add up to 500000 per beneficiary thats a high threshold.

When you contribute to a Future Scholar 529 College Savings Plan you can save for your childs future and save on your state income taxes all at the same time. Rhode Island Deduct up to 500 per year. SUBTRACTIONS FROM FEDERAL TAXABLE INCOME.

However some states may consider 529 contributions tax deductible. If you file a South Carolina tax return either as a resident or a non-resident you may be eligible for additional tax advantages. The top South Carolina income tax rate is 7 meaning that for each 1000 contributed to the state-sponsored 529 plan can save a taxpayer up to 70 when filing their tax.

South Carolina 529 Plan And College Savings Options Future Scholar

Metis Wealth Management And Planning South Carolina 529 Plan

529 Plan State Tax Benefits Map

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

How Do I Write Off 529 Plan Contributions On My Taxes Sootchy

529 Accounts In The States The Heritage Foundation

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

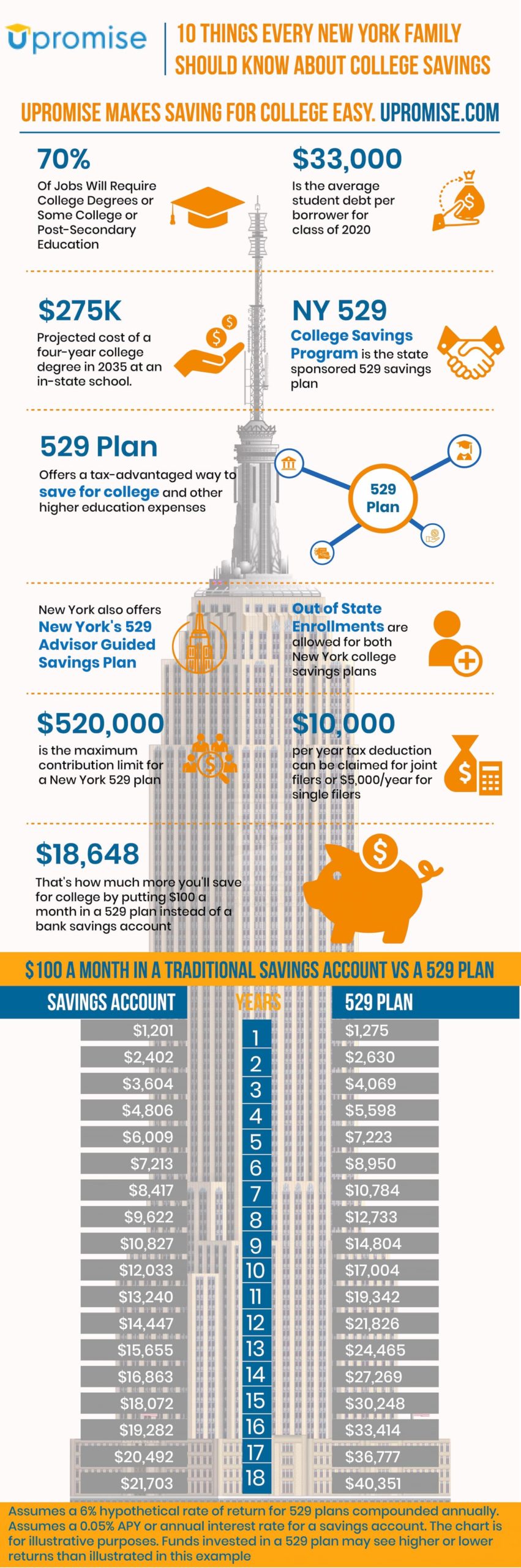

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

South Carolina 529 College Savings Plan Future Scholar 529

3 Reasons To Invest In An Out Of State 529 Plan

529 Tax Benefits The Education Plan

529 College Savings Plan Options Broken Down By State

North Carolina 529 Plans Learn The Basics Get 30 Free For College

North Carolina S National College Savings Program Your Nc 529 Plan Ppt Download

How Does An Nc 529 Tax Deduction Work Cfnc

North Carolina S National College Savings Program Your Nc 529 Plan Ppt Download